Calculate volatility for stock options

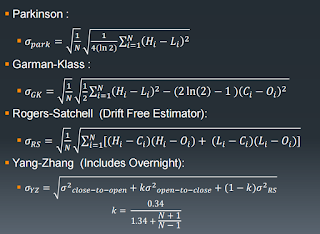

Though there are several ways to measure the volatility of a given security, analysts typically look to the historical volatility. Historical volatility is a measure of past performance.

Because it allows for a more long-term assessment of risk, historical volatility is widely used by analysts and traders in the creation of investing strategies.

To calculate volatility of a given security in Microsoft Excel, first determine the time frame for which the metric will be computed.

A day period is used for this example. Next, enter all the closing stock prices for that period into cells B2 through B12 in sequential order, with the newest price at the bottom.

Note that you will need the data for 11 days to compute the returns for a day period. In column C, calculate the interday returns by dividing each price by the closing price of the day before and subtracting one. Volatility is inherently related to standard deviation , or the degree to which prices differ from their mean.

B10 " to compute the standard deviation for the period. As mentioned above, volatility and deviation are closely linked. This is evident in the types of technical indicators that investors use to chart a stock's volatility, such as Bollinger Bands , which are based on a stock's standard deviation and the simple moving average SMA. However, historical volatility is an annualized figure, so to convert the daily standard deviation calculated above into a usable metric, it must be multiplied by an annualization factor based on the period used.

CBOE - IVolatility Services

The annualization factor is the square root of however many periods exist in a year. The example above used daily closing prices, and there are trading days per year, on average.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How can you calculate volatility in Excel? By Claire Boyte-White Updated June 7, — 4: The table below shows the volatility for McDonald's within a day period: Understand what metrics are most commonly used to assess a security's volatility compared to its own price history and that Dig deeper into the investment uses of, and mathematical principles behind, standard deviation as a measurement of portfolio Understand the basics of calculation and interpretation of standard deviation and how it is used to measure risk in the investment Understand the basics of standard deviation and average deviation, including how each is calculated and why standard deviation See how standard deviation is helpful in evaluating a mutual fund's performance.

Use it in combination with other measurements Understand how standard deviations and Bollinger Bands are used to measure market volatility and how this is helpful in establishing Think of standard deviation as a thermometer for risk, or better yet, anxiety. Check out how the assumptions of theoretical risk models compare to actual market performance.

Find out how much volatility global equity investors are in for during by seeing how much they've experienced over the past five years.

Discover the differences between historical and implied volatility, and how the two metrics can determine whether options sellers or buyers have the advantage.

Options Volatility | Implied Volatility in Options - The Options Playbook

Excel is a useful tool to assist with investment organization and evaluation. Find out how to use it. Find out how to adjust your portfolio when the market fluctuates to increase your potential return. Though most investors use standard deviation to determine volatility, there's an easier and more accurate way of doing it. Find out what to look out for when trading during market instability.

Volatile stocks can be a lucrative opportunity for short-term traders. For buy-and-hold investors, it's a much different story.

Use these calculations to uncover the risk involved in your investments. A statistical measure of the dispersion of returns for a given An estimation of a security's potential to suffer a decline in A measure of the dispersion of a set of data from its mean, calculated An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.