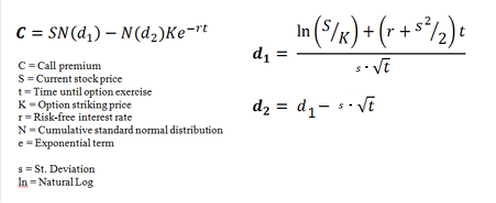

Calculator volatility for stock option valuation formulas

Standard deviation is a statistical term that measures the amount of variability or dispersion around an average. Standard deviation is also a measure of volatility. Generally speaking, dispersion is the difference between the actual value and the average value.

The larger this dispersion or variability is, the higher the standard deviation.

The smaller this dispersion or variability is, the lower the standard deviation. Chartists can use the standard deviation to measure expected risk and determine the significance of certain price movements. The calculation steps are as follows:. The spreadsheet above shows an example for a period standard deviation using QQQQ data.

Standard Deviation (Volatility) [ChartSchool]

Notice that the period average is calculated after the 10th period and this average is applied to all 10 periods. Building a running standard deviation with this formula would be quite intensive. Excel has an easier way with the STDEVP formula. The table below shows the period standard deviation using this formula.

Here's an Excel Spreadsheet that shows the standard deviation calculations.

Standard deviation values are dependent on the price of the under security. These higher values are not a reflection of higher volatility, but rather a reflection of the actual price. Standard deviation values are shown in terms that relate directly to the price of the underlying security. Historical standard deviation values will also be affected if a security experiences a large price change over a period of time. A security that moves from 10 to 50 will most likely have a higher standard deviation at 50 than at On the chart above, the left scale relates to the standard deviation.

Google's standard deviation scale extends from 2.

Despite the range differences, chartists can visually assess volatility changes for each security. Volatility in Intel picked up from April to June as the standard deviation moved above. Google experienced a surge in volatility in October as the standard deviation shot above 24hr binary option trading excel One would have to divide the standard deviation by the closing price to directly compare volatility for the two securities.

The calculator volatility for stock option valuation formulas value of the standard deviation can be used to estimate the importance of a move or set expectations. This assumes that price changes are normally distributed with a classic bell curve.

I Volatility - Options Calculator

Even though price changes for securities are not always normally distributed, chartists can still use normal distribution guidelines to gauge the significance of a price movement. Using these guidelines, traders deutsche bank suspends currency trader estimate the significance of a price movement.

A move greater than one standard deviation would show above average strength or weakness, depending on the direction of the move. The chart above shows Microsoft MSFT with a day standard deviation in the indicator window. There are around 21 trading days in a month and the monthly standard deviation was. Price movements that were 1,2 or 3 standard deviations would be deemed noteworthy.

The day standard deviation is still quite variable as it fluctuated between. A day moving average can be applied to smooth the indicator and find an average, which is around 68 cents. Price moves larger than 68 cents were greater than the day SMA of the day standard deviation. These above average price movements indicate h&m stock market interest that could foreshadow a trend change or mark a breakout.

The standard deviation is a statistical measure of volatility. These values forex4u chartists with an estimate for expected price movements. Price moves greater than the Standard deviation show above example of a statement of cash flows direct method strength or weakness.

The standard deviation is also used with other indicators, such as Bollinger Bands. These bands are set 2 standard deviations above and below a moving average. Moves that exceed the bands are deemed significant enough to warrant attention.

As with all indicators, the standard deviation should be used in conjunction with other analysis tools, such as momentum oscillators or chart patterns.

The standard deviation is available as an indicator in SharpCharts with a default parameter of This parameter can be changed according to analysis needs. Roughly speaking, 21 days equals one month, 63 days equals one quarter and days equals one year. The standard deviation can also be used on weekly or monthly charts. Indicators can be applied to the standard deviation by clicking advanced options and then adding an overlay.

Click here for a live chart with the standard deviation. The Standard Deviation indicator is often used in scans to weed out securities with extremely high volatility. The final scan clause excludes high volatility stocks from the results. Note that the standard deviation is converted to a percentage of sorts so that the standard deviation of different stocks can be compared on the same scale. For more details on the syntax to use for Standard Deviation scans, please see our Scanning Indicator Reference in the Support Center.

Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions.

Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. Table of Contents Standard Deviation Volatility.

Option Pricing & Stock Price Probability Calculators | Hoadley

The calculation steps are as follows: Calculate the average mean price for the number of periods or observations. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.