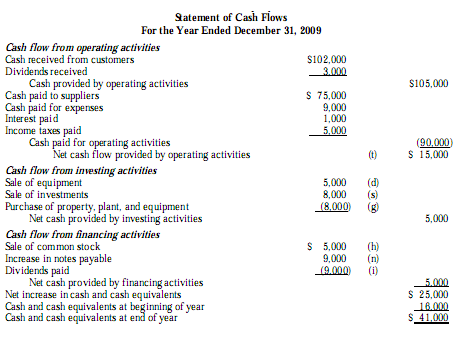

Example of a statement of cash flows direct method

Cash Flow Statement - Direct Method- Example, Format, Advantages - fesajina.web.fc2.com

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. In other words, changes in asset and liability accounts that affect cash balances throughout the year are added to or subtracted from net income at the end of the period to arrive at the operating cash flow. The operating activities section is the only difference between the direct and indirect methods.

The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows. This is not only difficult to create; it also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate.

Companies tend to prefer the indirect presentation to the direct method because the information needed to create this report is readily available in any accounting system. All you need is a comparative income statement. The indirect operating activities section always starts out with the net income for the period followed by non-cash expenses, gains, and losses that need to be added back to or ameritrade options stock td from net income.

These non-cash activities typically include:. Depreciation expense Amortization make free money nitto legends legends Depletion expense Gains or Losses from sale of assets Losses from accounts receivable.

The next section of the operating activities adjusts net income for the changes in asset accounts example of a statement of cash flows direct method affected cash. These accounts typically include:. Accounts receivable Inventory Prepaid expenses Receivables from employees and owners. This is where preparing the indirect method can get a little confusing.

Managerial Accounting Statement Cash Flow Direct MethodYou need to think about how changes in these accounts affect cash in order to identify what way income needs to be adjusted. When an asset increases during the year, cash must have been used to purchase the new asset.

Thus, a net increase in an asset account actually decreased cash, so we need to subtract this increase from the net income. The opposite is true about decreases. If an asset account decreases, we will need to add this amount back into the income.

The last section of the operating activities adjusts net income for changes in liability accounts affected by cash during the year. Example of a statement of cash flows direct method are some of the accounts that usually are used:.

Cash Flow Computations - Direct Method

Since liabilities have a credit balance instead of a debit balance like asset accounts, the liabilities section works the opposite of the assets section. In other words, an increase in a liability needs to be added back into income. Take accounts payable for example.

If accounts payable increased during the year, it means we purchased something without using cash. Thus, this amount should be added back. All of these adjustments are totaled to adjust the net income for the period to match the cash provided by operating activities. As you can see, the operating section always lists net income first followed by the adjustments for expenses, gains, losses, asset accounts, and liability accounts respectively.

Although most standard setting bodies prefer the direct method, companies use the indirect method almost exclusively.

MENU Accounting Topics CPA Exam Quizzes Examples Dictionary Careers Pro Course. Balance Sheet Statement of Retained Earnings.

Preparation of the Statement of Cash Flows: Direct Method

Search for more articles about the this method: Accounting Topics accounting courses accounting principles accounting cycle financial statements financial ratios.

Accounting Resources questions examples dictionary become a CPA careers. Accounting Careers CPA CMA EA CIA CFA.