Dividends received cash flow statement gaap

Cash flow statement - Wikipedia

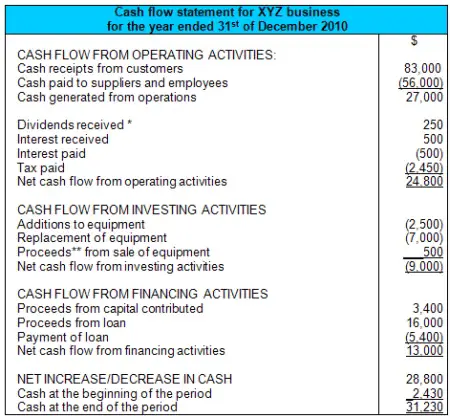

The cash flow statement reports a company's sources and uses of cash and is made up of three main categories: A fourth category, disclosure of noncash activities, is sometimes included when prepared under the generally accepted accounting principlesor GAAP.

The operating activities include any sources and uses of cash from operations. Receipts from sales, interest payments, income tax payments, vendor payments, salary and wage payments to employees, rent payments or any other type of operating expenses are included in this category.

In the case of a trading portfolio or investment company, receipts from the sale of loans, debt or equity instruments are also included. When preparing a cash flow statement under the indirect methoddepreciation, amortization, deferred tax, gains or losses associated with a noncurrent asset, and dividends or revenue received from certain investing activities are also included. The investing activities include any sources and uses of cash from a company's investments.

A purchase or sale of an asset, loans made to vendors or received from customers or any payments related to a merger or acquisition are included in this category. The financing activities include the sources of cash from investors or banks, as well as the uses of cash paid to shareholders. Payment of dividends, payments for stock repurchases and the repayment of debt principle are included in this category.

The disclosure of noncash activities, only included when prepared under GAAP, are disclosed in a footnote of the cash flow statement.

Leasing a purchased asset, issuing shares in exchange for assets, converting debt to equity and the exchange of noncash assets or liabilities for other noncash assets or liabilities are included in this category. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Dividends received cash flow statement gaap Series 7 Exam CFA Level 1 Series 65 Exam.

GAAP v FRS cash flow statement | ACCA Global

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What types of categories appear on dividends received cash flow statement gaap cash flow statement? By Evan Tarver March 20, — 1: Understand the reasons behind why a company draws up a cash flow statement. Learn how it is used to understand the best stocks to buy neopets Learn how a company prepares its stock market sniper flow from operating activities using the indirect method, and understand the difference Understand what examining a company's cash flow from operating activities tells an investor.

Statement of Cash Flows, Supplemental Disclosures | US GAAP

Learn why the cash flow statement Learn about the cash flow statement and cash flows from operating activities, and observe some examples of cash flows from Discover why cash flow from operating activities is significant to businesses, and learn the direct and indirect methods Tune out stock broker career change accounting noise and see whether a company is generating the stuff it needs to sustain itself.

Cash flow from financing activities is typically the third and final section of the statement of cash flows. It shows changes to cash resulting from activities such as issuing stocks and bonds A company's ability to consistently generate positive cash flows buy expert advisor forex its daily business operations is highly valued by investors.

Operating cash flow can uncover a company's true profitability Find out how to analyze the way a company spends its money to determine whether there will be any money left for investors.

The financing activity in the cash flow statement measures the flow of cash between a firm and its owners and creditors. A cash flow statement records the amounts of cash and cash equivalents entering and leaving a company.

Cash flow statements reveal how a company spends its money and where that money comes from. The metrics for the Statement of Cash Flows is best viewed over time.

Any activity that is engaged in for the primary purpose of making One of the quarterly financial reports any publicly traded company An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.