Stock market probability calculator

Greeks are computed for theoretical options at the current price, lower bound, upper bound, and days left. The calculator will compute probabilities regardless of whether an actual contract with matching price, strike, and expiration exists. Computed Greeks are NOT based on current market data, and the results may not be consistent with volatility and pricing used in other features on this site. Probability calculations are approximations and are subject to data errors, computation errors.

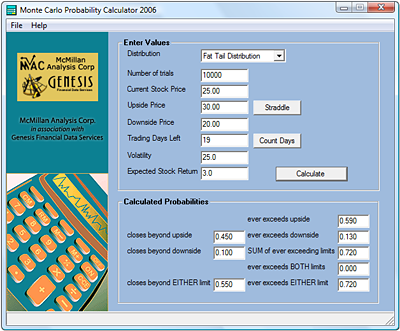

The calculator estimates the probability of future prices based on current market conditions or user entered data.

Stock Price Probability Calculator for SPY

Factors used as a basis for the probability computations are subject to change. Read the full disclaimer.

Option Calculators and Stock Screeners Symbol Lookup. The Probability Calculator evaluates option prices to compute the theoretical probability of future stock prices.

Data may be loaded for a symbol that has options, or data may be entered manually. To enter data for a specific symbol, enter a symbol in the text box labeled Symbol, then click Load Data for Symbol.

Price - is the current Stock Price Days - is the number of days in the future for which the probability will be computed. Days can be calculated by selecting an Expiration Date. Days are counted starting from the most recent trading day. NTM Volatility - Near The Money Volatility , is the implied volatility interpolated from current near term, near the money option contracts for the selected stock. Rate - is the approximate risk free interest rate. Next Dividend Date - The next ex-dividend date, which may be estimated from past dividend payments.

Calculating a Stock's Standard DeviationNext Amt - is the amount of the next dividend, which may be estimated from past dividend payments. Probabilities are computed assuming a lognormal distribution and a graph is provided. Lower and Upper bounds may be entered in the text box or selected from the list of available strikes for the selected stock.

The NTM Implied Volatility is used to compute option prices and greeks, which are displayed in the tables on the right. They are approximations and are not based on market data.

The Probability Calculator: Monte Carlo Simulation | Option Strategist

Option Calculators and Stock Screeners. Data Provided by HistoricalOptionData. Optionistics is not a registered investment advisor or broker-dealer.

We do not make recommendations as to particular securities or derivative instruments, and do not advocate the purchase or sale of any security or investment by you or any other individual.

By continuing to use this site, you agree to read and abide by the full disclaimer.