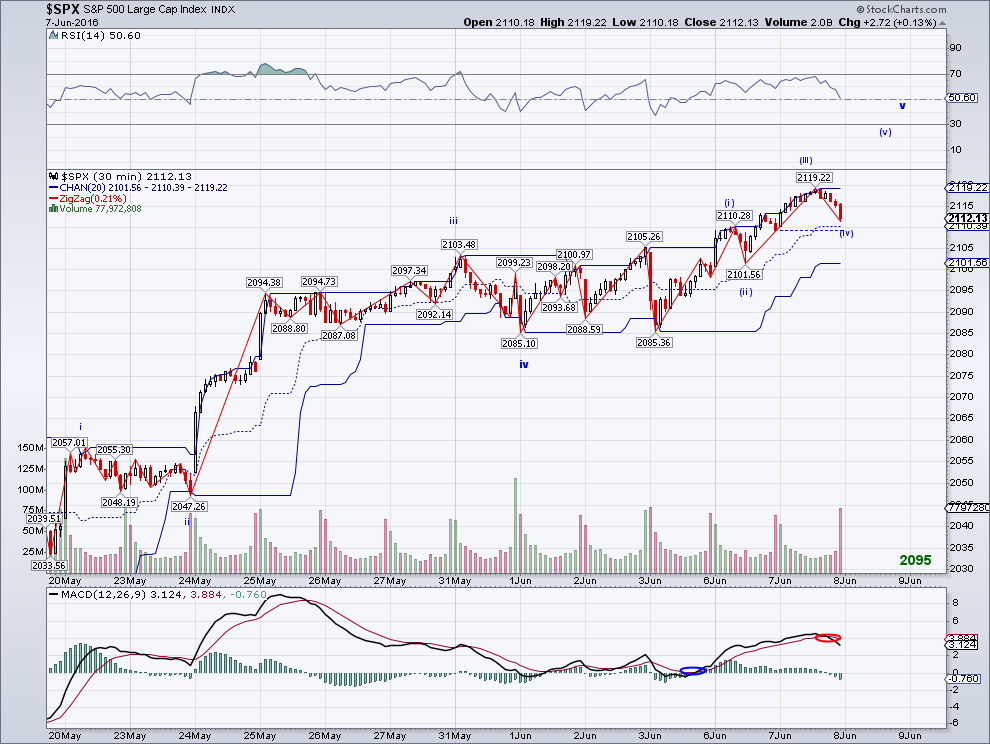

June 2016 stock market correctional

First there was the dotcom bubble when the NASDAQ reached an intraday trading high of 5, The NASDAQ lost half its value in and reached an all-time low of 1, It wasn't until April 23, when the previous new high was reached. We are seven years into a post housing bubble recovery.

The roughly 5 percent correction we've seen so far in may just be the beginning. Nobody really knows for sure.

What investors may wish to consider is compare the current economic situation with the historical downturns as an illustration of where the market may stand today, although past performance should not be considered a precursor to what the future may bring. Back in , investors focused on the metric "eyeballs.

One issue with this methodology was that Internet usage was shown to be relatively low. Only million out of an estimated million population were Internet users, or roughly 40 percent. Today, statistics show at least 80 percent of the United States' population are internet users based on the chart below.

Another big technology shift since is the development of the smartphone. The first iPhone was launched on June 29, GOOGL and the Open Handset Alliance. Take a look at mobile phone penetration since Notice how during the dotcom bubble handset penetration was below 38 percent.

These stock markets are in correction (or worse) - Jun. 28,

Today, handset penetration is more than percent given some people have more than one. And then there's the Apple NASDAQ: AOL and other previous generation tech giants traded on back in Google is a close second, which briefly surpassed Apple's market cap recently in early February. Not only are valuations much more reasonable today, so are the balance sheets as well. Before , credit was easy. Many banks pushed consumers into the subprime mortgage loans, defined as individuals with poor credit scores, who as a result of their deficient credit ratings, may not be eligible to quality for conventional mortgages.

According to a paper written by the St. Louis Fed, 18 percent of loans that were originated in and 14 percent of loans that were originated in were either past due for more than two months or were already in foreclosure within one year after the loans were originated. In comparison, only 2 to 6 percent of loans originated in the years from to were delinquent or in foreclosure during the first year after origination. In hindsight, it's clear that banks and their negative amortization and teaser loans, and in some cases, not conducting proper background checks on consumers such as verification of income and employment , directly led to a cascade of non-performing mortgage loans that brought down the real estate market.

Getting a new mortgage or refinancing an existing mortgage today is a much more difficult process as the government requires much more documentation from the borrower. In addition, banks are held to higher tier 1 capital ratios as protection from potential insolvency.

A bank's tier 1 capital ratio measures its financial health by comparing its core equity capital to total risk-weighted assets like loans. The theoretical reason for holding capital is that it should provide protection against unexpected losses.

This is not the same as expected losses, which are covered by provisions, reserves and current year profits. In the Basel III agreement, the minimum tier 1 capital ratio is 6 percent. In simple terms, the government wants banks to have higher ratios to protect consumers.

The two big challenges for mortgage applicants are the Qualified Mortgage QM rule and the Ability-to-repay rule established on Jan. Qualified mortgages follow requirements set by the Consumer Financial Protection Bureau.

Is A Major Stock Correction Likely In June? | Seeking Alpha

Before a borrower can qualify for a mortgage, the lender must have performed a concerted effort to help ensure the borrower has the "ability-to-repay" the loan, also known as the ATR rule. For example, a qualified mortgage can't include an interest-only period, negative amortization, balloon payments, excess upfront points and fees, or a loan term longer than 30 years.

This is where it gets more difficult for borrowers, both in documentation and dealing with lenders. In practice, this means banks and other mortgage originators have to validate a borrower's income, assets, credit history, monthly expenses, and employment situation. The bottom line is that getting a mortgage today is much more difficult than pre-housing crisis.

Looking beyond the large corrections since , the chart below indicates that booms and busts are an inevitability in the stock market. After each correction, however, the stock market has proved resilient by coming back strong. An important factor in building a robust investment portfolio is maintaining a consistent investment strategy during good and bad times. The next important factor is making sure your positions and stock weightings are aligned with your original goals and risk tolerance.

During violent upward and downward moves, position sizes may move further than expected.

As Warren Buffett said, "time in the market is more important than timing the market. A Look Back At The Last 2 Stock Market Corrections Mar. Online Brokerage, Investment Ideas, Stock Tr. Summary Stock market corrections and cycles are inevitable.

80% Stock Market Crash To Strike in , Economist Warns - The Sovereign Investor

Tech valuations today are nowhere near as high as they were in It is much more difficult to get a mortgage today due to new regulatory standards. Macro View , Market Outlook. Want to share your opinion on this article? Disagree with this article? To report a factual error in this article, click here. Follow Motif Investing and get email alerts.