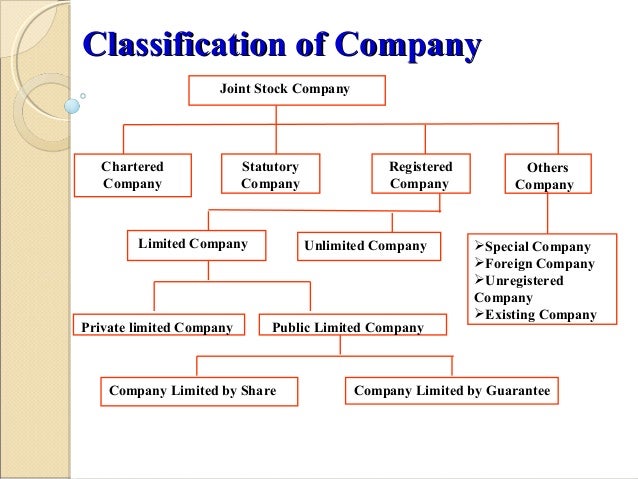

Classification of companies in stock market

Investors have different objectives, such as growth or income, and different investment horizons.

Hence, they seek out stocks that have the qualities that they look for. To satisfy this need, stocks have been categorized according to their investment characteristics. The most common categories are listed below.

Blue-chip stocks are stocks of large, stable companies that have a long history of stable earnings and dividends, and are typified by the stocks composing the Dow Jones Industrial Average, including General Electric, IBM, Microsoft, and Pfizer. Because of their large size, there is virtually no potential for a high growth rate, so most of the return of these stocks is in the form of dividends. However, capital gains can be earned from these stocks if they are bought in a bear market, when stock prices are depressed overall.

Income stocks generate most of their returns in dividends, and the dividends—unlike the dividends of preferred stock or the interest payments of bonds—will, in many cases, grow continuously year after year as the companies' earnings grow. These companies have a high dividend payout ratio because there are few opportunities to invest the money in the business that would yield a higher return on stockholders' equity. Hence, many of the these companies are already very large, and are also considered blue-chip companies, such as General Electric.

Cyclical stocks cycle with the economic cycles, going up strongly when the economy is growing and declining as the economy declines. Most of these companies supply capital equipment for businesses or big ticket items, such as cars and houses, for consumers. Some examples include Alcoa, Caterpillar, and Brunswick.

The best time to buy these stocks is at the bottom of a business cycle, then sell when the cycle peeks. Defensive stocks are issued by companies that are resistant to the economic cycles, and may even profit from them. When consumers and businesses cut back spending, a few other businesses profit, either because they offer a way to cut costs, or because they have the lowest prices. For instance, during the credit crisis of late and early , people tried to save by doing more for themselves.

This increased business for businesses that manufactured hair cutters and coloring kits. Auto repair shops tend to do better, because people cut back on the purchase of new cars, but cars nowadays are too complex for most people to fix on their own. And while most retailers were hurting significantly during the credit crisis, Wal-Mart was one of the few that actually thrived, since Wal-Mart is usually recognized as providing lower prices than other retailers.

Growth stocks are stocks of companies that reinvest most of their earnings into their businesses, because it can yield a higher return on stockholders' equity, and ultimately, a higher return to stockholders, in the form of capital gains, than if the money were paid out as dividends.

BSE stock classifications | Basics of Share Market

Note, however, that growth stocks are risky. So even if earnings remain stable, the stock price will decline. Another risk is bear markets—growth stocks will tend to decline much more than blue-chips or income stocks in a declining market, because investors become pessimistic, and will sell their stocks, especially those that pay no dividends.

One of the main benefits of growth stocks is that capital gains, especially long-term gains where the stock is held for at least 1 year, are generally taxed at a lower rate than dividends, which are taxed as ordinary income.

Tech stocks are the stocks of technology companies, which make computer equipment, communication devices, and other technological devices. Most tech stocks are listed on NASDAQ.

The stocks of most tech companies are either considered growth stock or speculative stock; some are considered blue-chip, such as Intel or Microsoft. However, there is considerable risk in tech companies because research and development efforts are hard to evaluate, and since technology is continually evolving, it can quickly change the fortunes of many companies, especially when old products are displaced by new products.

Speculative stocks are the stocks of companies that have little or no earnings, or widely varying earnings, but hold great potential for appreciation because they are tapping into a new market, are operating under new management, or are developing a potentially very lucrative product that could cause the stock price to zoom upward if the company is successful.

Many Internet companies were considered speculative investments. During the stock market bubble of the latter half of the 's, many of these stocks had ridiculous market capitalizations, and yet, many of them had virtually no earnings, and many, if not most, have since then, imploded.

A few, such as Amazon, have grown to become major corporations. Many speculative stocks are traded frequently by investors—or some would say, gamblers—in the hope of making a profit by timing the market, since speculative stocks range wildly in price as their perceived prospects constantly change.

Many of these companies can be found by looking at the components of the various indexes, such as the Russell Indexes. The large-cap stocks consists of the blue-chip, income, defensive, and cyclical stocks, since large companies have little potential for growth. Capital gains can be earned, however, by buying these stocks at the bottom of a business cycle and selling them as the economy reaches full speed. Large-cap stocks have the best price stability and the least risk.

Mid-cap stocks are composed of most of the categories listed here, since their market caps range from the top of the small-cap market to the bottom of the large-cap market. A particular kind of mid-cap stock are the baby blue-chip stocks , which are stocks of companies that, like the blue-chip companies, have consistent profit growth and stability, and low levels of debt, but are smaller in size than the large-cap blue-chips.

Stocks Basics: Different Types Of Stocks

Small-cap stocks are small companies that have the greatest potential for growth — hence, most of these stocks are growth or speculative stocks, and most tech stocks are also in this category, since many tech companies specialize in a narrow niche of the market, or they were started to develop a new product or service, such as the many Internet companies that sprouted during the stock market bubble.

In some cases, the small-cap stocks are distinguished from the even smaller micro-cap stocks.

Types of Stocks and Stock Classifications | Cash Cow Couple

Note that even the micro-cap stocks include only those stocks that are listed on major exchanges—they do not include OTC bulletin board securities or pink sheet stocks , which do not satisfy the requirements to be listed on a major exchange. Small-cap stocks tend to do better than other stocks at the beginning of an economic expansion, unless their growth is constrained by the availability of credit, since they rely more on bank financing than larger companies that can sell bonds directly to the market.

Personal Finance Bankruptcy Chapter 7 Chapter 13 Chapter 11 Credit and Debt Debt Collection Insurance Types of Insurance Auto Homeowner Health Life Real Estate Taxes Income Taxes Personal Deductions and Tax Credits Retirement Plans Gratuitous Transfer Taxes Educational Tax Benefits Taxation of Investments Business Taxes Wills, Estates, and Trusts Wills and Estates Trusts Investments Investment Fundamentals Investment Funds Mutual Funds Limited Partnerships Banking Bonds Types Of Bonds Government Securities Money Market Instruments Corporate Bonds Asset Backed Securities Forex Futures Options Stocks Stock Indexes Stock Valuation and Financial Ratios Technical Analysis Economics.