Butterfly option strategy ppt

Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. If you continue browsing the site, you agree to the use of cookies on this website. See our User Agreement and Privacy Policy. See our Privacy Policy and User Agreement for details. Published on May 26, Read this presentation I prepared with couple of my classmates for a case study in Advanced Finance at AIM.

Clipping is a handy way to collect and organize the most important slides from a presentation. You can keep your great finds in clipboards organized around topics. SlideShare Explore Search You. Show related SlideShares at end.

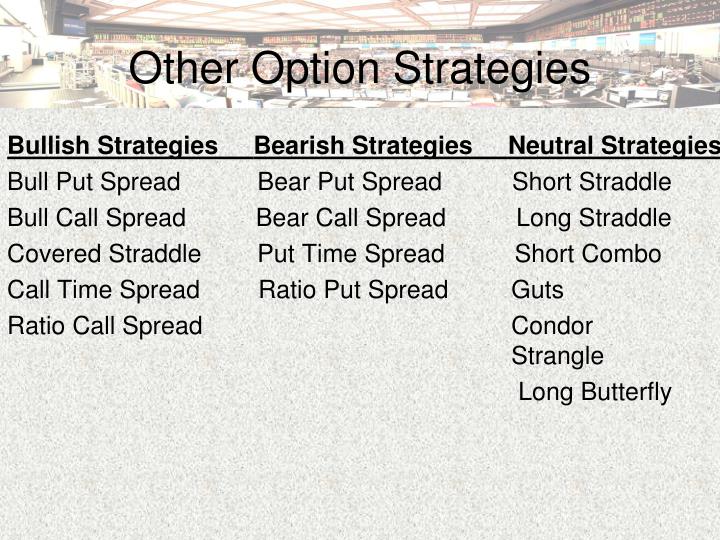

Long Butterfly Spreads: Understanding the Basics

Mayank Bhatia , Sr Account Manager Follow. Full Name Comment goes here. Are you sure you want to Yes No. Com Anthony Vanaki Hi Anthony, Just happen to see your offer to Mayank.

Do you have outsourcing jobs to be done? If you have, please contact me atrivedi02 gmail. Juanita Jonathan Trading is a good thing. I lost a lot before I got to were I am today. Hi my name is Godwin, I'm a trader. I will work with you and teach you my exact strategy.

Satish Phakade - Pawar , Director at InteGrowSys. Divya Pareek , Student at Mody university.

Embeds 0 No embeds. No notes for slide. Options Trading Strategies 1. The Option Investment Strategies Mayank Bhatia Sandri Supardi Gail Yambao 2. Gives the holder right to buy an assets at certain price within the specific period of time.

Gives the holder right to sell an assets at certain price within the specific period of time. Buy the stock of a listed company Profit Price S K S T 5. Buy a call option Profit Price S K S T Call option price 6.

Buy a Call Option When is this appropriate? Stock prices are expected to go up 1. Sell a call option Profit Price S K S T Call option price 9. Sell a Call Option 3. Buy a Put Option Profit Price S K S T Call option price Buy a Put Option When is this appropriate? When we expect prices to go down 2. Sell a Put option Profit Price S K S T Call option price Sell a Put Option 2. Covered Call Sell a call option and Buy Stock Profit Price S K S T Sell Call Covered Call Buy Stock Covered Call Buy a Stock, Sell a Call Option 55 exercise price of call K 5.

Protective Put Buy a put option and Buy a Stock option Profit Price S K S T Buy Put Protective Put Buy Stock It allows unlimited profits while limiting the potential loss. This establishes a floor, allowing unlimited profits while limiting the potential loss. Bull Spread Buy a Call at Low Strike Price, Sell Call at High Strike Price, Same Expiration Date 1. Bull Spread Buy a Call at Low Strike Price, Sell Call at High Strike Price, Same Expiration Date The investor expects stock prices to go up When is this appropriate?

Bear Spread Buy Call at High Strike Price, Sell Call at Low Strike Price, Same Exercise Date 1. Bear Spread Buy Call at High Strike Price, Sell Call at Low Strike Price, Same Exercise Date The investor expects stock prices to go down When is this appropriate?

Sell Put option and Buy Put on a higher strike price Profit Price S K 1 S T Buy Put Higher Price Put Bear Spreads Sell Put Lower Strike Price K 2 Sell 2 calls at K2 Buy Call option at K1 and K3. Profit Price S K 1 S T Sell 2 Call K2, close to current Stock Price.

Option Strategies |authorSTREAM

Sell 2 Puts at K2 and buy Put option at the price of K1 and K3 Profit Price S K 1 S T Sell 2 Put K2, close to current Stock Price. Straddle Buy Call and Put at the same Strike Price and Expiration Profit Price S S T Buy Call K Straddle Buy Put K K Strips Buy 1 Call and 2 Puts at the same Strike Price and Expiration Profit Price S S T Buy Call Kt Strips Buy 2 Put Kt K Straps Buy 2 Call and 1 Puts at the same Strike Price and Expiration Profit Price S S T Buy 2 Call Kt Straps Buy 1 Put Kt K Strangle Buy 1 Call and 1 Puts at the same Expiration date but with different Strike Price Profit Price S S T Buy 1 Call K2 Strangle Buy 1 Put K1 K 1 K 2 When is this appropriate?

Start clipping No thanks. You just clipped your first slide! Clipping is a handy way to collect important slides you want to go back to later. Now customize the name of a clipboard to store your clips.

Visibility Others can see my Clipboard.