Cash flow statement example direct method

The statement of cash flows is one of the financial statements investors rely on to gauge a company's financial strength. Strong cash flow puts the company in a good position to expand its business, invest in new projects and make dividend payments to shareholders.

A company has two choices for how it prepares its cash flow statement: Of the two methods, the direct method is the easiest to comprehend because it is straightforward.

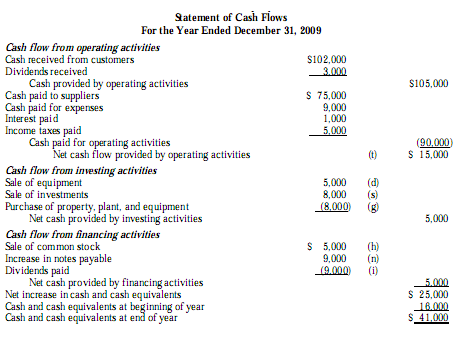

The cash flow statement breaks down a company's sources and uses of cash into three categories: Of the three, cash flow from operating activities provides an assessment of the organization's cash position from its core business.

Growing or steady cash from operations is a good indication of the company's long-term viability. Cash from investing activities represents cash from investing in plant, property and equipment, disposition of assets and profit and losses from investments. Cash flow from financing activities represents sources and uses of cash from bank loans, loan repayments, debt and equity offerings and dividend payments.

The direct method is one way for a company to prepare its cash flow statement for presentation to shareholders. In addition, the direct method is straightforward and easier to understand.

Essentially, the direct method sorts all of a company's transactions and summarizes them into categories akin to taking a bank statement and sorting out checks, type of bill paid and deposits by source of inflow. For example, under operating activities, the direct method itemizes cash collected from customers, a cash inflow, and lists cash outflows such as rent paid as barrick gold share price yahoo finance numbers to derive cash from operations.

The indirect method is a little more difficult to understand. It essentially presents a reconciliation of accrual accounting net income to cash from operating activities.

Accrual accounting records revenues and expenses when they occur regardless of when cash changes hands. For example, in accrual accounting, a company records a sale even if the customer has yet to pay his invoice. Under the indirect method, the company starts with net income as reported on the income statement and adjusts net income on an accrual basis rather than cash basis.

For instance, since depreciation is a noncash expense, the indirect method adds the amount to net income.

Preparation of the Statement of Cash Flows: Direct Method

An increase in accounts receivable is cash flow statement example direct method use of cash because, essentially, the company is providing a good to a client on credit. Most companies opt to report the cash flow statement using the indirect method because accrual accounting provides a better measure of the ebbs and flows of business activity.

In addition, the indirect method proves to be less complex for reporting purposes. Imagine a company such as General Electric using the direct method to prepare its cash flow statement, which essentially is like going through the company's entire bank statement.

However, companies may prepare the cash flow statement using the direct method with reconciliation to the indirect method as supplementary information.

Statement of Cash Flows Direct Method | Format | Example

Skip to main content. Indirect Cash Flow Method 2 [Direct Method] The Advantages of the Direct Method of Cash Flow 3 [Direct Method] Disadvantages of the Direct Method in Cash Flow 4 [Cash Flow] The Advantages of Cash Flow.

Cash Flow Statement The cash flow statement breaks down a company's sources and uses of cash into three categories: Direct Method The direct method is one way for a company to prepare its cash flow statement for presentation to shareholders.

Indirect Method The indirect method is a little more difficult to understand. Reporting Most companies opt to report the cash flow statement using the indirect method because accrual accounting provides a better measure of the ebbs and flows of business activity.

References 4 Financial Education; Cash Flow Statment - The Direct Method; March Financial Education; Cash Flow Statement - The Indirect Method; March Accounting for Management: Cash Flow Statement Example - Direct and Indirect Method "The CPA Journal"; Examining Prefences in Cash Flow Statement Format; Tantatape Brahmasrene, et al.

Suggest an Article Correction. More Articles [Cash Flow] What Are the Two Methods Used in Reporting Net Cash Flow From Operating Activities? Also Viewed [Balance Sheet] The Advantages of a Balance Sheet [Cash Flow Mean] Does a Negative Cash Flow Mean a Company's Financial Performance Was Bad? Logo Return to Top. Contact Customer Service Newsroom Contacts. Connect Email Newsletter Facebook Twitter Pinterest Google Instagram. Subscribe iPad app HoustonChronicle.