Contrarian forex trader

I want you to look at trading as two dimensional; somebody wins and somebody loses. It is the professional trader who takes on the risk of the retail trader the other side of your trades , after all, somebody has to sell you something or buy something from you when you want to place a trade.

The contrarian forex trade of the year | Futures Magazine

The professional therefore needs the market to move in the opposite direction to what you want it to move in, in order to profit. Thus, if you can learn to anticipate and think like a professional trader, you can begin improving your trading results….

Who is taking on the risk when you place a trade? Therefore, they are your opponent, and since the majority of retail traders lose, that means the person taking their risk and turning into profit, are the professional traders. Thus, you need to start thinking like a professional trader and stop thinking and behaving like an amateur when you trade.

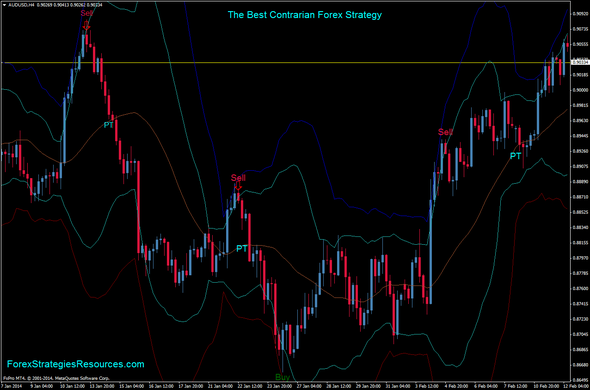

Again, looking at this two dimensionally: The trading strategy of the professional, no matter how complex one wants to make it, is simply to take on the retail trader and to take on other professionals opponents. The AUDUSD chart example below shows us a clear example of professionals taking on the risk of the amateurs.

As the market came back up and re-tested that key resistance near 0. The professional traders were already on-board and had already made their money by the time price started reversing up near 0. We can then see price failed to push back above key resistance on two occasions.

Volume Spread Analysis Trading Method - Forex Strategies - Forex Resources - Forex Trading-free forex trading signals and FX Forecast

This was caused by amateur traders thinking the uptrend would continue and a breakout was imminent. The professionals could sense that the up move was coming to an end and they gladly took on the risk of the more emotion-fueled, impulsive amateur traders….

The next example is the DAX30 — German Stock Index daily chart. Note the false break of the recent high in June, followed by another test and failure at that level, then the market just sold-off hard. The market then fell away dramatically, netting anyone who shorted a significant gain. Again, watching for false-breaks of key levels like this is very important as they often lead to huge moves in the other direction, which means quick profits to you, if you know how to spot the moves before they happen.

Successful traders know that trading is a game of anticipation. The strategy is contrarian, it might be with or against the trend, it may be inside a trading range, it can take on many forms.

The key is that you understand the concept clearly. That does not mean that every time markets go up, the pros are selling, and it does not mean every time the market goes down, the pros are buying, it does not suggest that at all. Once again, the concept I am trying to explain is a situation where one trader is taking on the risk of another trader, i. Asking yourself simple questions like these, before entering a trade, can significantly increase your chances of success in the market.

If a trend has already run for months, chances are the professionals have already made their money on it or at least have a lot of profit locked in.

He or she is calculated, he is reading the chart and he is reading the emotion of all market participants in that chart price action , he sees and feels the clues being printed day by day. He pounces with precision , striking his prey the herd with ice in his veins.

Some of the greatest traders have said you only need a simple horizontal line to trade the market successfully. I take that one step further and add price action confirmation signals , e. By trading at and around these key chart levels , we can also apply stricter risk control.

As can be seen, key horizontal levels allow for ideal risk management. Try drawing them in on your charts each day and week and you will see their effectiveness for yourself. If you think of the market as a sea of competitors, and within this sea of competitors is a school of traders much like a school of fish.

If you can imagine each short-term daily swing in the market as a school of lost fish following one another, you can shape the reality in your favor. How can I use price action signals and key market levels to guide me in taking on my opponents and taking an opposing view to the herd, the school, and the masses? If you start employing this logic from time to time, taking a step back and looking at the market from the opposite side of the fence the professionals side you may not only find some great trading opportunities, you may start avoiding some bad trades as well.

To learn more about trading like a professional by using simple price action strategies and key chart levels, checkout my trading course. Thanks again Nial for that BEST TRADING ADVICE.

It help me improve the way I THINK and TRADE the MARKET…. Thanks for the enlightenment, this is best knowledge i hve ever got and its increasing my capital greatly. Thanks Nial for this article. It has reminded me of all I used to use before I got sick over 2 years ago and stopped trading. I am feeling so much better and have been looking at charts again but was wondering where to start!!

Another life saver in the jungle of Forex trading-this is my way of describing your brilliant articles. This is why i recommend your website to my trader friends here in Nigeria. You are doing a great job in helping struggling traders find their bearing and locate the path to success. Your priceless contribution to the global trading community is highly commendable and your place as a worthy mentor can not be overemphasized. Once again you have clarified my trading approach. I felt there was an underlying cause to my trades and you have helped me tremendously.

I suspected as such on my own but you confirmed it. Hi Nial that a great article. I love the way you teach. It is what makes you unique from other mentors. Love your basic approach to trading. Keep up the great teaching! Thank you for sharing Nial Hi Nial One of the best posts. This comparison really hits home when I look back at my trades.

Thnks for all Nial Michele. I really like this article, Nial.

This is the nature of a zero-sum market… money literally changes hands. A great question that you ask: Similar to the way Jankovsky describes order flow in the market. Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information.

By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Learn To Trade The Market Pty Ltd, it's employees, directors or fellow members. Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets.

Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. Forex, Futures, and Options trading has large potential rewards, but also large potential risks.

The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets.

Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

How to Use Patterns in Contrarian FX Trading

Adopting A Contrarian Trading Method By Nial Fuller in Forex Trading Strategies 25 Comments. Thus, if you can learn to anticipate and think like a professional trader, you can begin improving your trading results… Taking on market risk Who is taking on the risk when you place a trade?

Conclusion If you think of the market as a sea of competitors, and within this sea of competitors is a school of traders much like a school of fish. To your success — Nial Fuller. Now I want to hear from you!

October 7, at 1: August 3, at 9: September 17, at 2: August 31, at 9: August 30, at August 28, at August 26, at August 24, at 9: August 24, at 3: August 23, at August 23, at 8: August 23, at 7: August 23, at 6: August 23, at 5: August 23, at 4: August 23, at 3: August 23, at 1: Leave a Comment Cancel reply Your email address will not be published.

Why You Should Take the Profits and Run! What I Learned After Taking Three Months Off From Trading Why Trading Against the Trend Will Destroy Your Account Why You Should Have a Favorite Market to Trade What Your Future Trading Self Would Tell You 10 Years From Now Let The Market Take You Out Of Your Trade The Psychology of Trade Profit Targets 10 Reasons Traders Fail to Make Money Trading A Simple Plan To Exit Your Trades Successfully 3 Ideas That Transformed My Trading Career The Power of The Pull Back Trading Strategy How To Anticipate Your Next Trade.

Categories Forex Trading Commentary Forex Trading Videos Forex Trading Strategies Forex Trading Articles Trading Lessons Blog Forex Trading Blog Trading Tools. Nial Fuller Learn To Trade Forex Price Action Trading Nial Fuller Reviews Beginners Forex Trading New York Close Charts Forex Broker. Copyright Learn To Trade The Market.