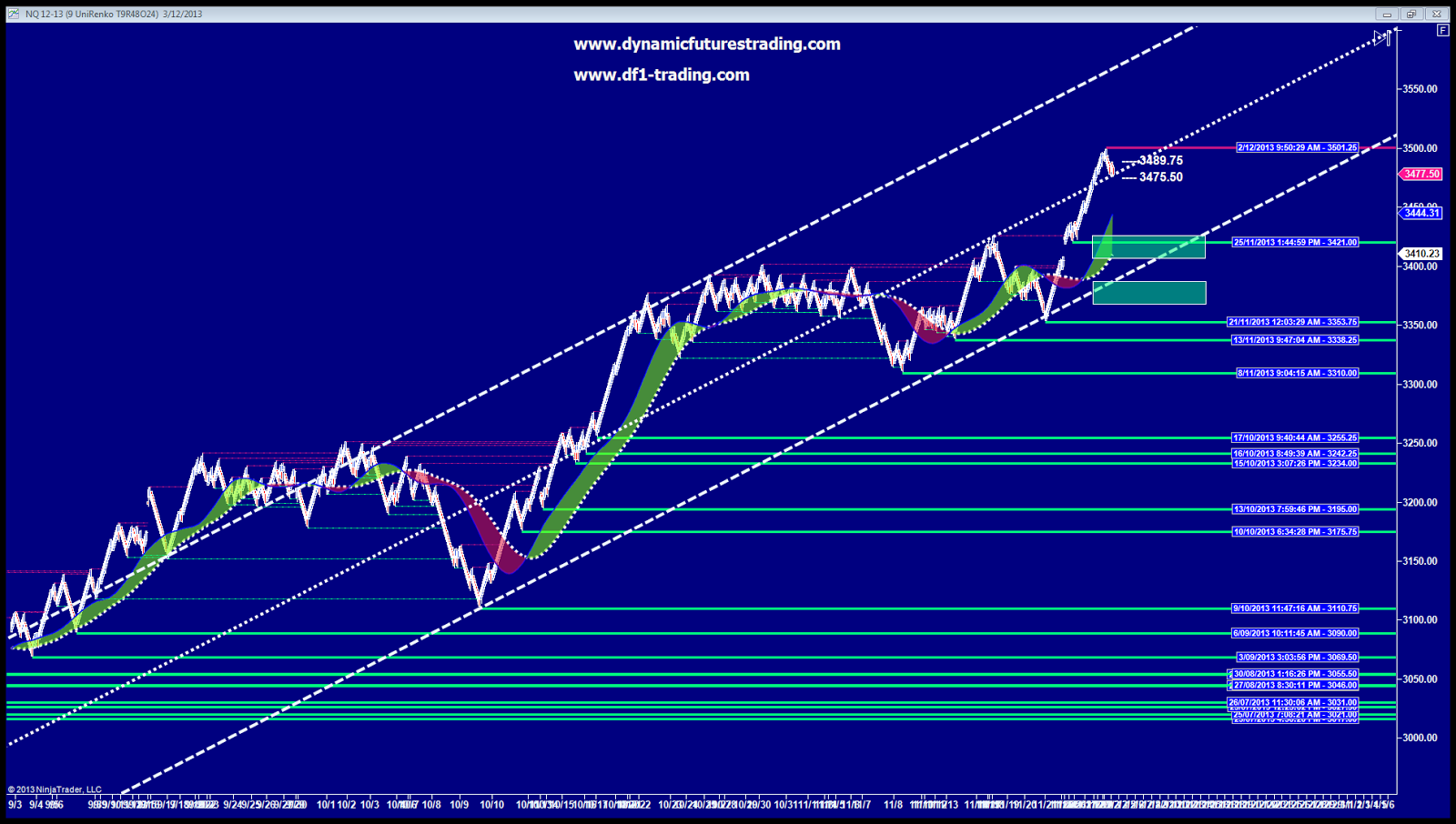

Nq trading strategies

Just 2 NQ points a day. Instead of trying to get every last tick out of a given move, I am content to consistently pull out a little bit, over and over.

This is the intent of the strategy. The strategy is based on these market attributes: The index futures NQ Nasdaq emini in my case tend to back and fill a lot.

One way trends are relatively rare. Important price levels are revisited over and over again. Market prices tend to move. Two points and then quit for the day should be achievable almost all the time. I just want to make chip shots. Just be consistent and do it over and over. A two point target is in the noise. Instead of trying to drink every last drop of a passing river, I want to dip my cup in and just catch a little of what is flowing by. Just a little portion of it.

All this time as a loser, I have been trading in hopes of catching a big move. I might have a 5 point target and a 2 point stop. I was constantly setting myself up for failure. I would enter at the market and hope for a big move, ready to take the small loss if need be. So I literally faded my strategy. I looked at the current market, and placed limit orders to fade moves roughly 3 points away from the current price. That put my entry at pretty much exactly where my stop loss would have been if I traded my old way.

Once one of them hit and was filled, I set a disaster stop of 5 points basically an arbitrary number at this point , and a profit limit order just two points away from my entry. Then I sat and waited. If the market kept going against me, I waited for it to come back. I honored the disaster stop, but in the first 18 paper trades it was never hit.

The Easiest E-mini?

Most of the time, I could get out for break-even or just a small loss close to 2 points. That exit for a small occasional loss is exactly where my trailing stop for a profit usually was under my old strategy.

I waited for the afternoon doldrums and tried when the market was listless, choppy and noisy, putting conditions in my favor.

Another positive element in this strategy is the very short time that I am exposed to the market. In some of the engineering applications I encounter in my work, a trade-off is made between accepting risk vs. A probabilistic design method is employed.

Instead of designing for the worst case failure mode at the worst possible time in all conditions, we look at the probabilities that these conditions may overlap. If the worst case failure only happens at very extreme conditions, and a vehicle only spends a tiny fraction of a percent of its service life at that condition, designing for this condition puts a large burden of weight and performance reduction for the entire class of vehicle across the whole service life.

We can slim down the vehicle by only designing to a probabilistically acceptable failure condition. We still have to avoid a disaster, so we make sure any failure is not catastrophic by keeping enough margin in the system. We just allow a failure to cause an aborted mission or acceptable amounts of damage. Back to my trading: While big adverse moves happen in the market, the odds that one of these moves come during the few short minutes that I am exposed to the market are very small.

But the shorter my exposure time, the smaller the probability of a big event becomes. Since the probability is not zero, I still have the disaster stop, just like in the vehicle design. I am not naive like that.

A non-zero probability is still possible. You have to prepare against it even though you will probably rarely see it. The biggest weakness I see is if I end up fading a persistent trend. That wipes out a lot of winning trades. This strategy would be best used during choppy sideways markets. How to rigorously define that is not clear to me. I want to take discretionary elements out for now. So the idea is literally fading my old self to have a winning strategy. This entry was posted on January 19, at You can follow any responses to this entry through the RSS 2.

You can leave a response , or trackback from your own site.

I thought about this type of strategy once also. I hear it quite a bit on ET. It seems like a perfectly reasonable strategy. For me at least, its not viable. Amazingly, his whole life does turn around for the better.

Perhaps sticking with a reasonable disaster stop will make some type of a difference, and perhaps your entering at places that are more likely to go your way than the other way, but in my personal opinion, I think your thinking about it in the wrong way just as I did.

If my stats are right not guaranteed! I have recently been to many of the emotional places you have, Your previous posts really made me feel like I was reading my own trading story. Whilst I am not an advocate of spruiking other people, Densie Shull has a couple of decent comments to make, and one of them is about having a trading goal of xx dollars per day. Its essentially trying to tell the market what to do, which is the reverse of reality.

The solution is just to trade your system, and the market will dictate whether you will be profitable. If you need to make xx points per day, your placing your personal success in someone elses hands. If your goal is just to trade well, then your in complete control.

I recently gave up trying to read the order flow after many hours of study. I have also turned my back on the ES and NQ. I was day trading the ES to make money, not for the joy it gave me. Quite the opposite, I felt like shit most of the time I was trading.

Great confidence, and I enjoy the time at the screen. After looking at your strategy and thinking about what your problem is very carefully, I now know what your problem is. Seriously dude, you have nothing, and it is little wonder you fail and constantly get stopped out for lots of small losses and the occasional big loss on this strategy. The trading computers and professional traders are eating you alive.

Document your last 3 trades. Exact entry, and exact exit and reasons for each. I think you will see that you actually do not even have a trading plan or strategy. This was my attempt at describing a strategy. It is not that you do not have a sold strategy. You have NO STRATEGY. If the gaps do not fill you will get continual losses, and no stop loss strategy would be able to help you. Sorry, I can provide you will many strategies that work, but I see no benefit to that.

Just 2 NQ Points A Day | Read the Prospectus

You need to to develop one of your own that works for you. Not take another persons trading strategy and think that you can apply it the same way. Do you use skype at all? I have a blog on here too. Your site was brought up in the Trade the Markets live trading room today in regard to the Average Vol.

They look cool by the way.

Emini Trading Blog

Hi, I think your website might be having browser compatibility issues. When I look at your blog in Opera, it looks fine but when opening in Internet Explorer, it has some overlapping.

I just wanted to give you a quick heads up! Other then that, wonderful blog! You are commenting using your WordPress.

NQ traders let's talk! - Emini Index Futures Trading | futures io social trading

You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email. Notify me of new posts via email. Entries RSS and Comments RSS.

Read the Prospectus Trading, Think or Swim, Ninjascript and other Rocket Science. Potential First Trade of the Year: On a 5 min NQ chart, around half of all the bars are wider than 2 points: The average daily range for NQ lately is near Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public.