Inside bar forex trading strategy

Justin Bennett is a Forex trader, coach and founder of Daily Price Action. He began trading equities and ETFs in and later transitioned to Forex in His "aha" moment came in when he discovered the simple yet profitable technical patterns he teaches today.

Justin has now taught more than 1, students from 53 countries in the Daily Price Action course and community. Follow JustinBennettFX Recent Lessons. However, the effectiveness of the inside bar strategy is largely based on the price action surrounding it. In other words, an inside bar alone does not constitute a valid trade setup.

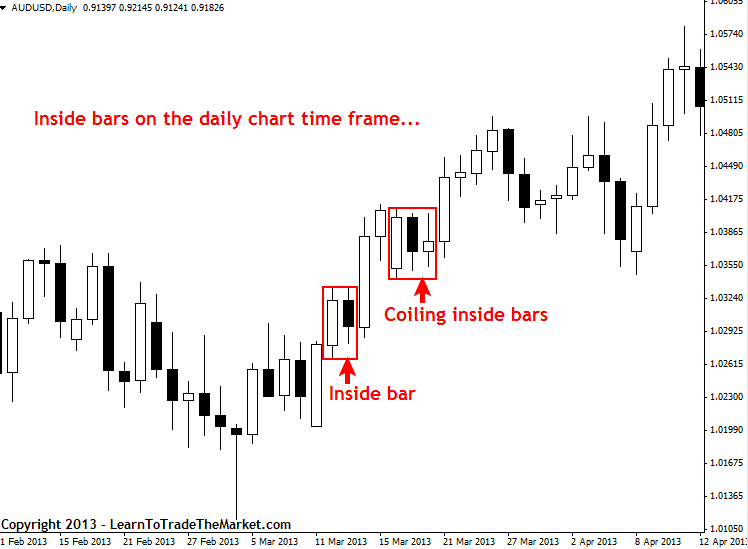

We need additional clues to tell us that the potential reward is worth the associated risk. As the name implies, an inside bar or inside candle , is any period on your chart that forms inside of the previous perio d. If you look at a one hour chart, you can probably find multiple inside bars in a single day, whereas you might find just one or two inside bars on the daily chart for the same currency pair.

The chart below shows multiple inside bars in a consolidating market.

Inside bar Forex trading strategy

The example above was an uptrend but they are just as effective if not more in a strong downtrend. Why does size matter? That might sound confusing for now, but it will soon make sense, I promise! In order to properly explain relative size, we need to discuss how to enter an inside bar trade and where to place our stop loss.

The best place to enter an inside bar is on a break of the mother bar high or low in the direction of the trend. So now we know where to enter the inside bar trade, but to really understand why relative size is important we need to understand where to place our stop loss order. We have two options when placing our stop loss order.

The first option is to place our stop loss just below the mother bar low.

The second option is to place the stop loss below the inside bar low. Just know that we should always aim for, at minimum, a 1: So if our stop loss needs to be 50 pips away, our profit target must give us at least pips. The EURJPY example above works for us, because there was no immediate resistance above. The stop loss would need to be pips away from our entry, and the trade would have easily given us pips or more. On the surface this looks like a valid inside bar trade setup.

We have an inside bar on the daily chart in a strong downtrend…everything looks good. As you can see, previous support and resistance levels play an important role when determining whether an inside bar is worth trading.

Inside Bar Trading Strategy: How to capture momentum and ride trends (with low risk)So, what this means that relative size of the inside bar to the mother bar is important, but support and resistance levels are equally important. They all go hand in hand if you ask me.

I see many traders making the mistake of taking inside bar trades without clearly defining their support and resistance levels. This is just asking for trouble. You need to know what previous price action has done in order to put the odds in your favor.

This is true for any type of price action setup, not just inside bars. I hope this lesson has provided you with some helpful tips that you can implement in your trading plan.

Inside Bars (And How to Trade Them)

If you liked this post, please share it with your friends using the social sharing buttons below. How do you trade inside bars?

Post your comments or questions below. Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Daily Price Action, its employees, directors or fellow members.

Futures, options, and spot currency trading have large potential rewards, but also large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. Forex, Futures, and Options trading has large potential rewards, but also large potential risks.

The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose.

Fakey Trading Strategy | Learn How To Trade The Fakey Setup In Forex

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Private Trading Community Login Sign up for a lifetime membership. Why I Ditched Technical Indicators And Why You Should Too. How to Profit From the Head and Shoulders Pattern And Avoid Common Mistakes.

Inside Bar Trading Strategy | fesajina.web.fc2.com

Trading the Broadening Wedge: Your Start to Profit Guide. How to Use Fibonacci Retracement to Spot Market Tops and Bottoms. The 3-Step Approach to Forex Money Management and Risk Control. A Simple Yet Powerful Approach. Inside Bar Forex Trading Strategy: Copyright by Daily Price Action, LLC.