Call option downside protection

Stocks and most other securities are not insured the way bank deposits are, so you might lose money. Downside protection reduces your risk. Hedging is the most straightforward type of downside protection.

You can hedge your investment in XY Company by purchasing a put option for shares of the stock. If the price goes up, you let the option expire and all you lose is the premium you paid to buy the put option. Hedging an investment with put options is a short-term strategy. If you plan on holding shares for just a few months, put options are an excellent way to invest with downside protection.

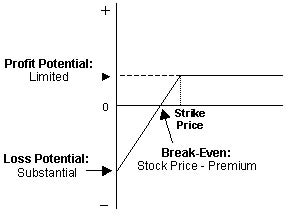

Another strategy for investing with downside protection is to write a covered call option. The purchaser of the call contract has the right to buy the shares from you at the strike price.

Call Option Definition & Example | Investing Answers

If the price declines or does not go up to the strike price before the option expires, you keep the premium the purchaser paid. The premium provides some downside protection by offsetting part of any drop in the stock price. One negative feature of covered calls as downside protection is that you give up the possibility of making more money if the stock price goes above the strike price. If that happens, the holder of the contract you wrote will exercise the option and you have to sell him your shares at the strike price.

Covered calls are a sophisticated strategy for reducing downside risk usually employed by experienced options traders. A stop-loss order is an instruction to your broker to sell stock or another security if the price falls below a specified level.

The 6 Most Common Portfolio Protection Strategies

However, stop-loss orders provide effective downside protection for momentum traders who buy shares and then sell them the same day or within a few days. Momentum traders try to anticipate short-term price fluctuations and operate on small profit margins. An unexpected dip in a stock price can make a big difference. The use of stop-loss orders insures a quick response to such surprises and keeps potential losses to a minimum.

Hedging Hedging is the most straightforward type of downside protection. LImitations Hedging an investment with put options is a short-term strategy. Covered Calls Another strategy for investing with downside protection is to write a covered call option. Stop Loss A stop-loss order is an instruction to your broker to sell stock or another security if the price falls below a specified level. Covered Call Yahoo Finance: Why Stop-Loss Orders Are a Bad Sell.

Can Covered Calls Be Sold in an IRA Account? Stock Options Explained in Plain English How to Hedge Call Options How to Make Consistent Returns With Options How to Trade Leveraged Stock Options Ways to Play a Bear Market.

Conservative Option Strategies Tradable Stock Options Risky Option Strategies Can I Hedge a Call Option With a Put Option? Bull Put Spread Vs.

30 August 2016: New option structure opened on DEC16ALSI for downside protection.Bull Call Spread Is a Margin Account Required for Trading Options? More Articles You'll Love.

Downside Protection Definition - fesajina.web.fc2.com

Can I Hedge a Call Option With a Put Option? Is a Margin Account Required for Trading Options? How to Hedge a Stock Portfolio Against a Crash.

Stock Options Explained in Plain English. How to Hedge Call Options. How to Make Consistent Returns With Options. How to Trade Leveraged Stock Options.

How do I Invest With Downside Protection? - Budgeting Money

Ways to Play a Bear Market. The Variables That Drive a Stock Option's Value. About Us Careers Investors Media Advertise with Us Check out our sister sites. Privacy Policy Terms of Use Contact Us The Knot The Bump.