Visa credit card exchange rates euro

You're headed overseas for vacation, but you can't tell what your best bet is when it comes to spending. Should you convert some cash at your bank or the airport, withdraw from an ATM once you get there, or try to stick mostly to credit? To get the best currency exchange rate, swiping your credit or debit card for purchases when overseas is probably your best bet.

Regardless of your credit card issuer, credit card exchange rates are the same across the board because they're determined by the major networks -- Visa, MasterCard and American Express. When you swipe your card while abroad, your card's network processes it using a rate that's close to the current market rate and sends the final figure to your issuer, he explains. It's far superior to what you'd get at a bank or a currency exchange shop or if you're changing at the airport," he says.

He says the card network rates are 5 to 10 percent better than those offered by financial institutions such as bank branches that convert currency. It's an even bigger spread when comparing to exchange shops on the street or in the airport.

He's a retired mortgage banker in South Carolina who has traveled to more than 70 countries and took an around-the-world trip with his wife. Each time he travels, he relies on his credit card.

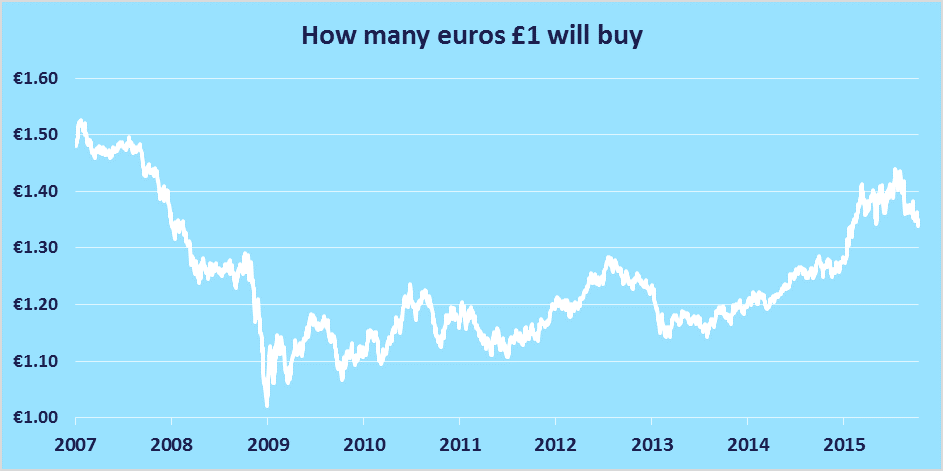

On July 17, for example, according to the market rate on XE. Visa's exchange rate comes much closer to that listed on XE.

How credit card conversion rates are set Ridout suggests that Visa and MasterCard are able to secure such competitive rates because they have lower overhead costs than, say, an exchange kiosk that has to be staffed.

The networks are also converting currency in large volumes. Visa and MasterCard say they give consumers "wholesale currency market" or "government mandated" rates that are set either the day before or on the day the transaction is processed. MasterCard says it uses multiple market sources, including Bloomberg, Reuters and central banks, to set exchange rates.

Both Visa and MasterCard agree that consumers get the best value by swiping their cards while abroad. American Express says it doles out a fair market rate to its clients, too. The rate we use is no more than the highest official rate published by a government agency or the highest interbank rate we identify from customary banking sources on the conversion date or the prior business day," spokeswoman Jane Di Leo said in an email.

We will bill charges converted by establishments such as airlines at the rates they use," she noted.

Pitfalls to avoid To take advantage of the savings you get by using a credit card abroad, steer clear of these traps:. Dynamic currency conversion When you're making a purchase with your debit or credit card, and the terminal prompts you to choose between U. This is called dynamic currency conversion. You should never do that," Ridout warns. Choose the local currency and you'll get your credit card's rate, instead of the merchant's rate, which is usually not as favorable.

Foreign transaction fees Credit card currency conversion rates lose a lot of their luster if your card charges a foreign transaction fee. These fees typically range from 1 to 3 percent of the transaction amount.

American Express, for example, sets the transaction fee at 2. When you're talking about the best currency conversion rate, it's without question credit and debit. But a growing number of issuers offer cards with no transaction fees.

Chase says a majority of its credit cards don't have foreign transaction fees, including its J. Morgan Select, Chase Sapphire Preferred, Marriott Rewards Premier, British Airways Visa Signature, Southwest Airlines Rapid Rewards Premier and United Mileage Plus cards. All Discover and Capital One credit cards are free of foreign transaction fees, too.

For a more complete listing of foreign transaction fees, see " More cards bid farewell to foreign transaction fees. ATM withdrawal fees Ridout notes that using your debit card to withdraw cash overseas also offers exchange rates that are nearly on par with the market rate. Just make sure you aren't getting hit with too many ATM withdrawal fees.

These are usually a flat rate per withdrawal. Some banks and credit unions will reimburse you up to a certain amount for any ATM fees you're charged for, Ridout says. Others will waive fees if you use ATMs at affiliated banks, so ask about both options before you go.

Holly Johnson, a personal finance writer and founder of the blog Club Thrifty, goes abroad a few times a year and says she waits to get cash for small purchases until she arrives at her destination.

Then, she uses a debit card that waives fees for using certain ATMs and she only withdraws enough to get her through the trip. After that, she relies on a credit card that doesn't charge foreign transaction fees. Almost everywhere you go, they will take Visa, MasterCard or AmEx and you can avoid fees and the dreaded task of changing your money back when you get home," Johnson says.

One Reason to Obtain a US Dollar Credit Card | Canadian Capitalist

To be safe, bring two different cards from two different issuers in case one ends up with a fraud warning or a network issue. Cash advance fees Unless you have no other choice, avoid using your credit card for a cash advance overseas. While the exchange rate will be good, you'll be hit with cash advance fees of 3 to 5 percent on most cards.

Plus, interest will begin accruing immediately and the interest rate will be as much as 7 percent above your purchase APR. Simply provide your basic information, and view offers that match your credit profile within seconds.

XE - Credit Card Charges Calculator

No Fees No Annual Fee No Foreign Transaction Fee. Tools Get your free Credit Score Airlines or Low Interest Calculator Cash Back or Low Interest Calculator Payoff Calculator. Best Rated Cards from our Experts Best Balance Transfer Cards Best Low Interest Cards Best Cash Back Cards Best Business Cards. Best Travel Cards Best Airline Cards Best Hotel Cards Best Student Cards.

FairFX Currency Cards, International Payments, Travel Cash

Credit Type Excellent Credit Good Credit Fair Credit Bad Credit Limited or No Credit History. Search by Network or Bank MasterCard Visa American Express Discover Wells Fargo. Bank of America Capital One Citi Chase Barclaycard. Connect with us Subscribe: RSS News Feeds Subscribe: Card Offers Top Offers Best Credit Cards Credit Card Comparison Tools.

Credit Cards Credit Card News Getting the best exchange rate abroad - Editorial Policy. Based on July 17 rates Bank of America: Three most recent Credit account management stories: A second credit card: When it's wise to get one, when it's not — Adding more plastic to your wallet can be an asset, but it's not for everyone Credit Card Rate Report. Home Privacy Policy California Privacy Rights. Home Site Security Privacy Policy California Privacy Rights Site Map FAQs.

About Us Overview Leadership Team Media Center Careers. Contact Us Customer Support Partnership Opportunities Business Development Media Relations. International Sites Tarjetas de Credito UK Credit Cards Canadian Credit Cards.

Stay connected with CreditCards.